The Indian govt (Union Cabinet) has introduced the Unified Pension Scheme (UPS) to benefit around 2.3 million government employees. This scheme will be effective from April 1, 2025, and offers employees the choice between the UPS and the existing New Pension Scheme (NPS).

- The Union Cabinet, headed by PM Narendra Modi. This approval ensures that government employees and their families will have financial security through the new pension scheme.

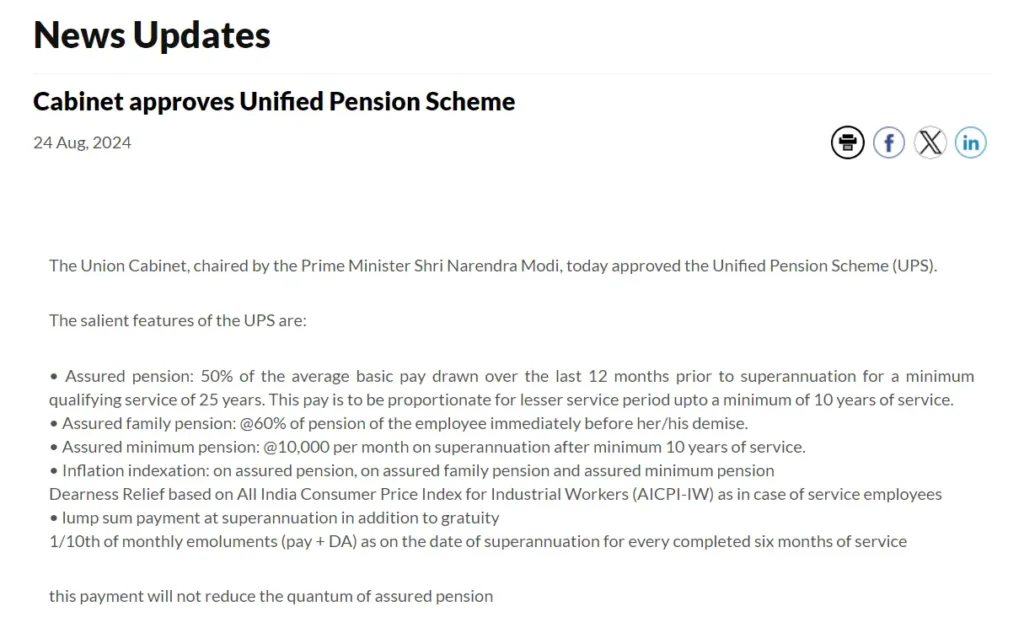

Key Features of UPS

here is a simplified summary of the key features of the Unified Pension Scheme (UPS):

Assured Pension

- Eligibility: Employees with at least 25 years of service.

- Amount: 50% of the average basic pay from the last 12 months before retirement.

- Proportionate Pension: For those with less than 25 years but at least 10 years of service, the pension is proportionate to their tenure.

Assured Family Pension

- Eligibility: In case of the employee’s death.

- In case of pensioner death: The pensioner’s family will receive 60% of the pensioner’s last drawn salary.

Assured Minimum Pension

- Eligibility: Employees with at least 10 years of service.

- Amount: ₹10,000 per month upon retirement.

Inflation Indexation

- Adjustment: Both the assured pension and family pension are adjusted for inflation to maintain their value over time.

Dearness Relief

- Eligibility: Retirees under the UPS.

- How is it calculated?: Based on the All India Consumer Price Index for Industrial Workers (AICPI-IW), just like it is for current employees.

Lump Sum Payment on Superannuation

- Eligibility: At the time of retirement.

- Amount: 1/10th of the employee’s monthly emoluments (including pay and Dearness Allowance) for every completed six months of service.

- Download Admit card: SSC CGL Admit Card 2024 (Tier I) released @ssc.nic.in

Key Features of UPS

Guaranteed Pension

- Pension Amount: Employees will receive 50% of their average basic pay from the last 12 months before retirement.

- What happens if the pensioner passes away? – The pensioner’s family will receive 60% of the pensioner’s last drawn salary.

Increased Government Contribution

- Contribution Rate: The government’s contribution to the pension fund will increase from 14% to 18%.

Benefits of UPS

Financial Security

- Fixed Pension: The New scheme ensures a fixed pension post the employee’s retirement, addressing the drawbacks of the NPS.

- Inflation Adjustments: The scheme includes provisions for inflation adjustments, enhancing financial stability for retirees.

Flexibility and Choice/ Scheme Options

What choices do government employees have? They can choose between two pension schemes:

- Unified Pension Scheme (UPS): Offers guaranteed pensions and better financial security.

- National Pension System (NPS): This scheme offers benefits based on market performance. However, a major criticism is that it carries a high risk due to market fluctuations.

It gives employees flexibility and the choice to pick the option that best suits their needs.

Implementation Timeline

- Effective Date: The UPS will be implemented from April 1, 2025, giving employees time to understand and prepare for the changes.

Addressing Criticisms of NPS

- Public and Political Concerns: The UPS was introduced in response to significant opposition to the NPS, particularly from states like Himachal Pradesh and Rajasthan.

- Guaranteed Pension: The UPS guarantees a fixed pension amount, ensuring financial stability for retirees.

Takeaway

Unified Pension Scheme (UPS)

The Unified Pension Scheme (UPS) is a new government policy, aiming to provide assured pensions and enhanced financial security for government employees.

Why is it important? It fixes the issues people had with the old National Pension System (NPS) by offering more stable and predictable retirement benefits.

1 thought on “Unified Pension Scheme (UPS) Explained: Key features”